Free Tax Filing 2020 With Schedule B

2020 Schedule B Form. You must fill out this form and attach it to Form 941 or Form 941-SS if youre a semiweekly schedule depositor or became one because your accumulated tax liability on any day was 100000 or more.

Write your daily tax liability on the numbered space that corresponds.

Free tax filing 2020 with schedule b. HR Blocks Free Online tax filing service gives you more for free than TurboTax Free Edition. You must sign and send in a written request to the IRS. Individual Income Tax Return.

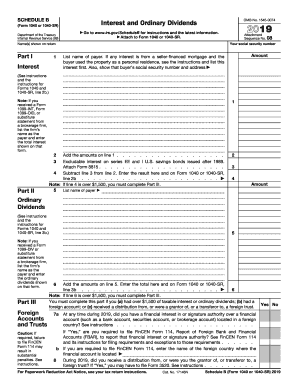

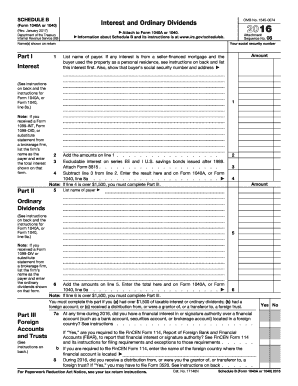

Special Considerations When Filing. 2019 Schedule B Instructions. However you dont need to attach a Schedule B every year you earn interest or dividends.

HR Block Free Online. 2018 Schedule B Form. Additional Income and Adjustments to Income.

The TaxAct Online Free Edition makes free federal filing available for simple returns only. DIY Options to File for Free. 2020 Schedule B Instructions.

It is only required when the total exceeds certain thresholds. HR Block offers two DIY options to file taxes for free HR Block Free Online plus another free option offered through a partnership. Use Schedule B Form 1040 if any of the following applies.

Profit or Loss From Business. Start Free and File Free. If you became a semiweekly schedule depositor during the quarter you must complete Schedule B for.

It does not provide for reimbursement of any taxes penalties or interest imposed by taxing authorities and does not include legal representation. 14 Zeilen Free In-person Audit Support is available only for clients who purchase and use HR Block desktop software solutions to prepare and successfully file their 2019 individual income tax return federal or state. 2018 Schedule B Instructions.

Find out if you have a simple return and more about what this years Free Edition includes. The IRS Free File program is a Public-Private Partnership PPP between the IRS and the Free File Alliance a coalition of leading tax preparation software companies. Simple filers with dependents college expenses unemployment income or retirement income file their federal taxes for free.

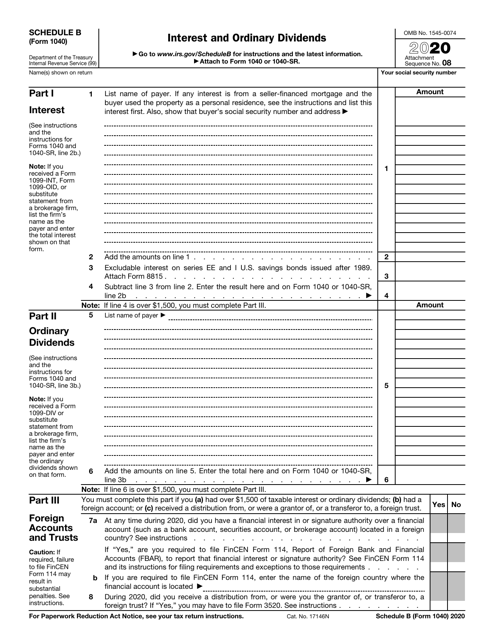

Schedule B reports the interest and dividend income you receive during the tax year. 0 00 State Additional. Schedule B should not be used to report any tax-exempt interest shown on Form 1099-INT.

For all other products you can start free and pay only when you file. Additional terms and restrictions apply. Here are the Schedule B requirements.

TaxAct includes all free simple federal income tax forms you need to do your taxes. You received interest from a seller-financed mortgage and the buyer used the property as a. The Schedule B has three sections.

31 Zeilen US. If your annual gross income in 2020 was less than 72000 you can use one of the Free File software programs offered to submit federal taxes free. HR Block Free Online is designed for people with less complex filing situations including taxpayers who have W-2 income kids and rent as well as students and first-time filers.

Not everyone has a simple return. Youre a semiweekly schedule depositor if you reported more than 50000 of employment taxes in the lookback period or accumulated a tax liability of 100000 or more on any given day in the current or prior calendar year. Supplemental Income and Loss.

To complete the interest section you need to separately report the name of each institution that sends you a 1099-INT form and the amount of interest it reports. HR Block Free Online. Capital Gains and Losses.

File income taxes online easily with fast online IRS e-file. Parents employees and students in particular will appreciate all of the fast easy features that make filing simple returns a breeze. Interest and Ordinary Dividends.

Tax forms supported with free version. IRS Free File partners are online tax preparation companies that offer what is called the IRS Free File program which provides free electronic tax preparation and filing of federal tax returns at no cost to qualifying taxpayers some may also offer free state returns. If you got an IRS notice informing you of the estimated tax penalty send your abatement request to the.

The IRS Free File. File Schedule B if youre a semiweekly schedule depositor. Form 1040 Schedule A itemized deductions Schedule B interest and dividend income Schedule C small business schedule D.

Click any of the IRS Schedule B form links below to download save view and print the file for the corresponding year. 2019 Schedule B Form. These free PDF files are unaltered and are sourced directly from the publisher.

You had over 1500 of taxable interest or ordinary dividends. When you file this form with Form 941 or Form 941-SS dont change your tax liability by adjustments reported on any Forms 941-X or 944-X. In 2020 for example a Schedule B is only necessary when you receive more than 1500 of taxable interest or dividends.

Interest ordinary dividends and foreign accounts and trusts. That information should be reported on Form 1040.

Publication 908 02 2021 Bankruptcy Tax Guide Internal Revenue Service

:max_bytes(150000):strip_icc()/schedB-7250cc494af24b9fa7dd368806aafcc5.jpg)

Schedule B Interest And Ordinary Dividends Definition

Irs Schedule B 1040 Form Pdffiller

Irs Schedule B 1040 Form Pdffiller

Irs Schedule B 1040 Form Pdffiller

Irs Schedule B 1040 Form Pdffiller

Irs Schedule B 1040 Form Pdffiller

Completing Form 1040 With A Us Expat 1040 Example

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Publication 908 02 2021 Bankruptcy Tax Guide Internal Revenue Service

Irs 1040 Forms And Instructions Fill Pdf Online Download Print Templateroller

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Understanding The 1065 Form Scalefactor

Completing Form 1040 With A Us Expat 1040 Example

Instructions For Form 1040 Nr 2020 Internal Revenue Service

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Publication 908 02 2021 Bankruptcy Tax Guide Internal Revenue Service

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Post a Comment for "Free Tax Filing 2020 With Schedule B"